Using accrued expenses acknowledges that the liability is valid and records it as such. That way, the ledger accounts for all income and expenses created during that time period. You only record accrued expenses in your books if you run your business under the accrual basis of accounting. While the cash method of accounting recognizes items when they are paid, the accrual method recognizes accrued expenses based on when service is performed or received. Because of additional work of accruing expenses, this method of accounting is more time-consuming and demanding for staff to prepare. There is a greater chance of misstatements, especially if auto-reversing journal entries are not used.

What Is the Journal Entry for Accruals?

Notice of an adjourned meeting need not be given other than by announcement at the meeting at which adjournment is taken. (b) A majority of the directors shall be members and a majority of the directors shall be elected exclusively by the members holding patron membership interests unless otherwise provided in the articles or bylaws. (a) The members may amend the bylaws to fix a greater quorum or voting requirement for members, or voting groups of members, than is required under this chapter. An amendment to the bylaws to add, change, or delete a greater quorum or voting requirement for members shall meet the same quorum requirement and be adopted by the same vote and voting groups required to take action under the quorum and voting requirements then in effect or proposed to be adopted, whichever is greater. (3) the bylaws or amendment is approved by a majority vote cast, or for a cooperative with articles or bylaws requiring more than majority approval or other conditions for approval, the bylaws or amendment is approved by a proportion of the vote cast or a number of the total members are required by the articles or bylaws and the conditions for approval in the articles or bylaws have been satisfied. (d) Upon filing with the secretary of state of the articles for compliance with this chapter and the certificate required under paragraph (c), a cooperative organized under chapter 308A is converted and governed by this chapter unless a later date and time is specified in the certificate under paragraph (c).

What is an example of an accrued expense?

Unless a restriction is in this chapter, the articles, bylaws, noted conspicuously on the face or back of the certificate, or included in information sent to the holders of uncertificated membership interests, a restriction, even though permitted by this section, is ineffective against a person without knowledge of the restriction. A restriction under this section is deemed to be noted conspicuously and is effective if the existence of the restriction is stated on the certificate and reference is made to a separate document creating or describing the restriction. (2) may include by reference some or all of the terms of any agreements, contracts, or other arrangements entered into by the cooperative in connection with the establishment of the class or series if the cooperative retains at its principal executive office a copy of the agreements, contracts, or other arrangements or the portions will be included by reference. Except as provided in subdivision 3, a member’s financial rights are transferable in whole or in part. Unless the appointment of a proxy contains a restriction, limitation, or specific reservation of authority, the cooperative may accept a vote or action taken by a person named in the appointment.

Subd. 2.Restatement required.

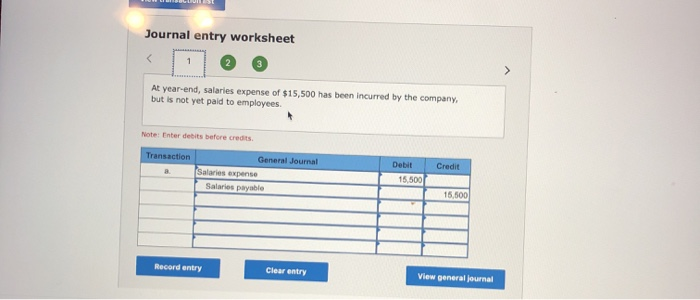

When it’s paid, Company ABC will credit its cash account for $500 and credit its interest payable accounts. First, when the expense is incurred, we create a journal entry for it — and create a debit based on accounts payable. So accrued expenses are a payable account that is a liability on your balance sheet.

ORGANIZATION

(b) A cooperative organized under chapter 308A that becomes subject to this chapter must provide its members with a disclosure statement of the rights and obligations of the members and the capital structure of the cooperative before becoming subject to this chapter. A cooperative organized under chapter 308A, upon distribution of the disclosure required in this subdivision and approval of its members as necessary for amending its articles under chapter 308A, may amend its articles to comply with this chapter. (ii) for a cooperative with articles or bylaws requiring more than majority approval or other conditions for approval, the amendment is approved by a proportion of the votes cast or a number of total members as required by the articles or bylaws and the conditions for approval in the articles or bylaws have been satisfied. If the first board is not named in the articles of organization, the organizers may elect the first board or may act as directors with all of the powers, rights, duties, and liabilities of directors, until directors are elected or until a contribution is accepted, whichever occurs first.

The offset to an accrued expense is an accrued liability account in double-entry bookkeeping. The offset to accrued revenue is an accrued asset account and this also appears on the balance sheet. An adjusting journal entry for an accrual will therefore impact both the balance sheet and the income statement. Accrued interest is recorded on an income statement at the end of an accounting period.

- Prepaid expenses are payments made in advance for goods and services that are expected to be provided or used in the future.

- If not otherwise provided in the articles or bylaws, distributions shall be made on the basis of value of the capital contributions of the patron membership interests collectively and the nonpatron membership interests to the extent the contributions have been accepted by the cooperative.

- (b) Subject to paragraph (c), a written restriction on the assignment of financial rights that is not manifestly unreasonable under the circumstances and is noted conspicuously in the required records may be enforced against the owner of the restricted financial rights or a successor or transferee of the owner, including a pledgee or a legal representative.

- (c) A cooperative shall maintain its records in written form or in another form capable of conversion into written form within a reasonable time.

- The resolution is effective three days after delivery to the members is deemed effective by the board, or, if the statement is not required to be given to the members before the acceptance of contributions, on the date of its adoption by the directors.

With an accrual basis, transactions are recorded when the work is done or the cost is acquired. Accrued expenses are also called accrued liabilities because they become a debt you owe, based on receiving a product, service, or operational expense. If you use cash accounting, you won’t record accrued expenses because you’ll if an expense has been incurred but will be paid later, then: only record the expenses once the employee is paid in July. But with accrual, the expenses show up on your income statement in June as your employee purchases the supplies. When the company’s accounting department receives the bill for the total amount of salaries due, the accounts payable account is credited.

Wherever this chapter provides that a particular result may or must be obtained through a provision in the articles or bylaws, the same result can be accomplished through a member control agreement valid under this section or through a procedure established by a member control agreement valid under this section. (a) A restriction on the assignment of financial rights may be imposed in the articles, in the bylaws, in a member control agreement, by a resolution adopted by the members, by an agreement among or other written action by the members, or by an agreement among or other written action by the members and the cooperative. A restriction is not binding with respect to financial rights reflected in the required records before the adoption of the restriction, unless the owners of those financial rights are parties to the agreement or voted in favor of the restriction.

The transferee is liable for the debts, obligations, and liabilities of the transferor only to the extent provided in the contract or agreement between the transferee and the transferor or to the extent provided by law. (d) The member shall express a choice by marking an appropriate choice on the ballot and mail, deliver, or otherwise submit the ballot to the cooperative in a plain, sealed envelope inside another envelope bearing the member’s name or by an alternative method approved by the board. An action by a cooperative is not valid or legal in the absence of a quorum at the meeting at which the action was taken. Regular members’ meetings shall be held annually at a time determined by the board, unless otherwise provided for in the bylaws. (c) The right of inspection granted by this subdivision shall not be abolished or limited by the articles, bylaws, or any actions of the board or the members. The board may elect additional officers as the articles or bylaws authorize or require.