So, if a creditor or lender wants to highlight the owner’s equity, this version helps paint a clearer picture if all assets are sold, and the funds are used to settle debts first. A lender will better understand if enough assets cover the potential debt. The accounting equation is so fundamental to accounting that it’s often the first concept taught in entry-level courses. It offers a quick, no-frills answer to keeping your assets versus liabilities in balance. Liabilities are claims on the company assets by other companies or people.

What Are the Key Components in the Accounting Equation?

The accounting equation is not always accurate if it is unbalanced. This can lead to inaccurate reporting of financial statements and incorrect decisions made by management regarding money and investment opportunities. To further illustrate the analysis of transactions and their effects on the basic accounting equation, we will analyze the activities of Metro Courier, Inc., a fictitious corporation. Refer to the chart of accounts illustrated in the previous section. An error in transaction analysis could result in incorrect financial statements. An accounting transaction is a business activity or event that causes a measurable change in the accounting equation.

What Are the 3 Elements of the Accounting Equation?

During the month of February, Metro Corporation earned a total of $50,000 in revenue from clients who paid cash. Most sole proprietors aren’t going to know the knowledge or understanding of how to break down the equity sections (OC, OD, R, and E) like this unless they have a finance background. Still, you’ll likely see this equation pop up time and time again.

Components of the Accounting Equation

Owner’s or stockholders’ equity also reports the amounts invested into the company by the owners plus the cumulative net income of the company that has not been withdrawn or distributed to the owners. Equity represents the portion of company assets that shareholders or partners own. In other words, the shareholders or partners own the remainder of assets once all of the liabilities are paid off. An asset is a resource that is owned or controlled by the company to be used for future benefits.

Assets

- It will always be true as long as all transactions are appropriately accounted for and can never fail or be out of balance for any given entity.

- Like any brand new business, it has no assets, liabilities, or equity at the start, which means that its accounting equation will have zero on both sides.

- The accounting equation ensures that the balance sheet remains balanced.

- Additionally, you can use your cover letter to detail other experiences you have with the accounting equation.

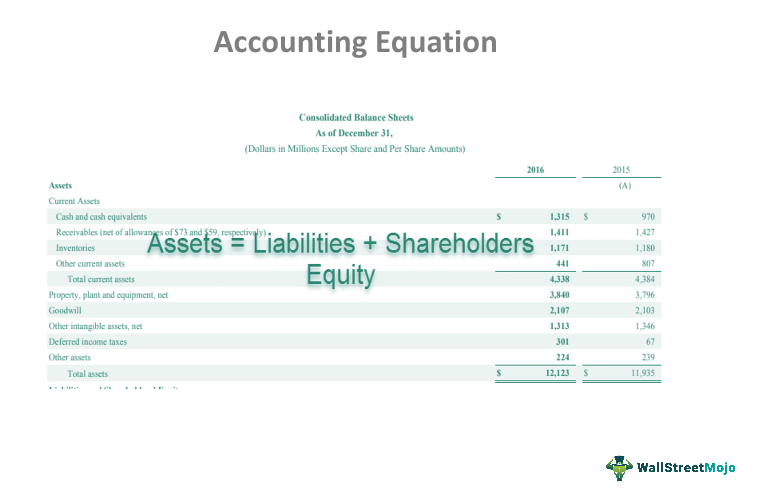

- Accounting equation describes that the total value of assets of a business entity is always equal to its liabilities plus owner’s equity.

- So, if a creditor or lender wants to highlight the owner’s equity, this version helps paint a clearer picture if all assets are sold, and the funds are used to settle debts first.

The impact of this transaction is a decrease in an asset (i.e., cash) and an addition of another asset (i.e., building). The rights or claims to the properties are referred to as equities. Cash (asset) will reduce by $10 due to Anushka using the cash belonging to the business to pay for her own personal expense. selling or refinancing when there is an irs lien As this is not really an expense of the business, Anushka is effectively being paid amounts owed to her as the owner of the business (drawings). The cash (asset) of the business will increase by $5,000 as will the amount representing the investment from Anushka as the owner of the business (capital).

Shareholder Equity is equal to a business’s total assets minus its total liabilities. It can be found on a balance sheet and is one of the most important metrics for analysts to assess the financial health of a company. As you can see, all of these transactions always balance out the accounting equation. This equation holds true for all business activities and transactions.

Like any brand new business, it has no assets, liabilities, or equity at the start, which means that its accounting equation will have zero on both sides. In other words, the total amount of all assets will always equal the sum of liabilities and shareholders’ equity. The double-entry practice ensures that the accounting equation always remains balanced, meaning that the left-side value of the equation will always match the right-side value. Essentially, the representation equates all uses of capital (assets) to all sources of capital, where debt capital leads to liabilities and equity capital leads to shareholders’ equity.

The balance sheet is also referred to as the Statement of Financial Position. After six months, Speakers, Inc. is growing rapidly and needs to find a new place of business. Ted decides it makes the most financial sense for Speakers, Inc. to buy a building. Since Speakers, Inc. doesn’t have $500,000 in cash to pay for a building, it must take out a loan. Speakers, Inc. purchases a $500,000 building by paying $100,000 in cash and taking out a $400,000 mortgage.

Unearned revenue from the money you have yet to receive for services or products that you have not yet delivered is considered a liability. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.